Demand for instant payments is growing

Real-time payments are steadily growing due to globalization and market demand for instant transfers. In the United States alone, The Clearing House’s real-time system processed 49 million real-time transactions worth $22.7 billion in Q4 2022.

With the potential real-time payments bring, global banks and financial institutions have had to grapple with a fragmented ecosystem of financial message formats, complex processes, and legacy systems.

ISO 20022 migration presents unique challenges for banks due to the complexity and scale of the transition. However, the richer data provides unparalleled new possibilities to create value, reduce costs, and improve customer experiences.

In this blog post, we’ll help you understand:

- The strategic imperative driving ISO 20022 adoption

- How to manage change and use the migration to your advantage

- Why process orchestration is crucial for future-proof payments

What is ISO 20022?

ISO 20022 is an open, international standard for financial messaging that aims to provide a common language and data model for messages used in financial transactions. The International Organization for Standardization (ISO) maintains this standard in collaboration with the International Electrotechnical Commission (IEC)

SWIFT estimates that cross-border payment flows will exceed $250 trillion by 2027, underlining the importance of a universal standard like ISO 20022.

Source: SWIFT

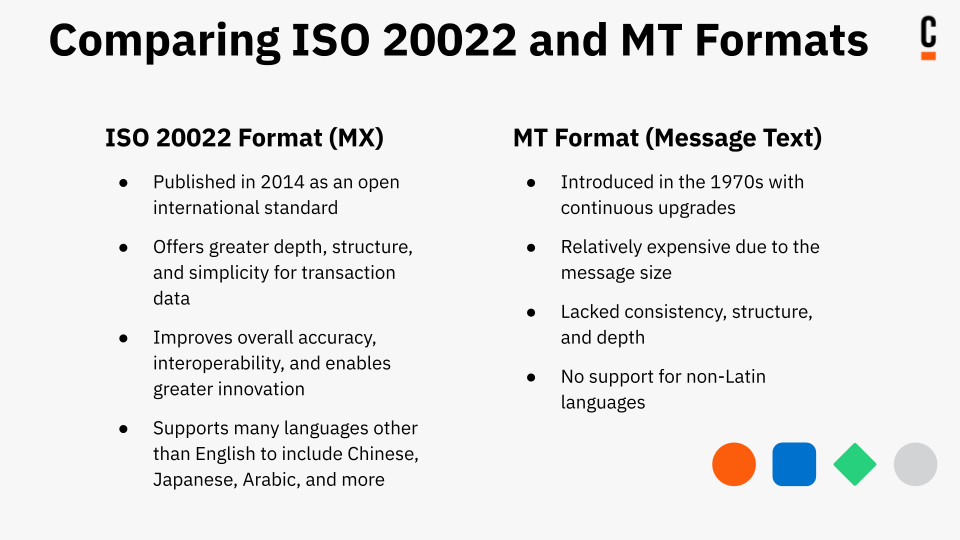

ISO 20022 is a new data standard for payment messaging that provides richer, more structured data compared to legacy formats like MT (message text). Benefits include stronger interoperability between institutions, more transparency, and a higher degree of straight-through processing from the rich, structured data.

Historically, organizations had proprietary methods for sharing this data, causing delays and inefficiencies, which only compounded as our global economies became more interconnected. This fragmented payments landscape created barriers to straight-through processing and increased processing times, manual interventions, and costs.

Over 70 countries worldwide have already adopted the ISO 20022 messaging standard. In 2023, the Bank of England went live with ISO 20022 for CHAPS (Clearing House Automated Payment System), which is the UK’s high-value payment system. The Federal Reserve in the United States plans to migrate to ISO 20022 for their Fedwire Funds Service and Fedwire Securities Service by 2024. Similarly, the European Payments Council (EPC) has set a deadline of November 2025 for full migration to ISO 20022.

By 2025, SWIFT estimates that nearly 90% of all high-value cross-border traffic will utilize the new standard, creating a compelling reason to update crucial systems or risk payments being denied.

Difference between MT and ISO 20022 (MX)

ISO 20022 offers rich formatting options and the ability to capture both structured and unstructured information. This makes it easier to process data efficiently and saves time by reducing the need for manual intervention.

Although infrastructure migration can present challenges, institutions can use this opportunity to reimagine how they deliver value to customers.

Better data, integration, and resilience

The rapid adoption of the standard is driven primarily by the richness of data it provides. The new standard enables two-way communications between organizations, such as “request for payment,” “request for information,” and “confirmation of payment.”

The depth and structure of the data allow organizations to derive richer insights from transactions and innovate value-added services while simultaneously reducing costs by improving automation rates. It also supports non-Latin languages such as Chinese, which is invaluable in our global economy.

The open standard also enhances an institution’s risk position and operational resilience due to the improved interoperability between banks and transparency of the messages. The rich data ensures that anti-money laundering processes are performed with a higher degree of accuracy and at lower cost due to requiring less manual intervention.

Additionally, operational resilience grows by using the new standard. With operational resilience mandates such as DORA in the EU, operational resilience in the UK, and US federal regulations, resilient payment processes and infrastructure is a requirement.

Modernization offers high returns

The key value drivers of ISO 20022 are rich formatting options and the ability to capture structured and unstructured information. This seamlessly gives way to efficient processing and time savings from improved straight-through processing rates. It can also speed up investigations and resolutions if a payment fails.

The migration to the ISO 2022 standard means that more data is flowing through payments infrastructure than ever before. A single message can contain anywhere from three to ten times the amount of information for a transaction.

That data can be used to accelerate and enhance KYC and AML processes, which improves customer experiences while reducing risks and overall costs. It can also be leveraged for regulatory reporting processes as the higher degree of accuracy and automation will help to minimize compliance costs.

Better data provides more opportunities

Increasing straight-through processing rates and enhancing compliance are important to note, but there is even more to gain from ISO2022. Smart banks are looking at ISO 20022 as an opportunity to use the data to unlock more value for their customers.

With richer transaction data, organizations can use this information to generate insights into customer behavior. In turn, they can leverage this data to create new value streams or update existing business models to generate more revenue.

Although migrating infrastructure to be compliant is a significant change that can present challenges, banks can use this opportunity to ultimately offer better services and maintain client-centricity. At the same time, corporations and clients can benefit from the data-rich messages.

Challenges with modernizing payments

Previously, the payments ecosystem relied on a fragmented collection of transaction message types and proprietary bank standards. This led to inaccuracies, a lack of harmony, and increasingly expensive investigations.

There are also major roadblocks to modernization in the forms of legacy systems, process complexity, and change management. All three create headwinds against any transformation initiative, and the difficulties are multiplied by the interconnected and increasingly global nature of payments.

Legacy systems

The industry is one of the oldest, and it’s not uncommon to find critical technology in use that is 20+ years old. Additionally, this legacy technology is used in hundreds of business-critical workflows, increasing the risk of disruption and regulatory scrutiny.

Process complexity

Payments processes are incredibly complex and impact hundreds of processes. Within a single payment flow, there’s complex business logic to route and filter payments to the right systems or people. This logic isn’t always clear or easy to comprehend, further compounding the difficulty in achieving strategic alignment between business and IT teams on what’s needed–and technically possible–for updating a payment process.

Organizational change

Change management is foundational to a successful transformation project but sometimes an afterthought. With the scope of payment processes, there are several different teams that need to understand the impact and agree on an approach for modernization.

Bedrock vs. bandaid solutions

Like any transformation project, organizations need to weigh the costs and potential returns for their approach. A careful and strategic approach requires bringing together a diverse set of stakeholders to ensure both the business goals and technical realities are aligned.

Given the scale ISO 20022 migration poses, some organizations may consider shortcuts to meet deadlines. Using ‘converters’ or ‘translators’ is an easy win to bookend a payment process and ingest and map the data to be compliant. However, shortcuts come with long-term risks. Loss of data and inaccuracies caused by converters can erode the potential upside that inspired the ISO 20022 format.

While they may help to achieve compliance deadlines, it’s important to take a more long-term and sustainable approach to migration. Native support for ISO 20022 unlocks the full potential of the standard, allowing for a greater use of data to identify and deliver business insights that can inform strategy.

How process orchestration can help

Complex and business-critical processes in the payment space are ideal candidates for process orchestration.

Visibility and alignment

Designing a front-to-back payment process visually can highlight the full impact and provide areas for improvement. Using a standards-based notation to model and show precisely how a process runs helps to align teams on the business and technical requirements needed. This results in faster delivery as there’s a common language used to review the full process before implementation begins.

Performance and resilience

Payments never stop at close of business. The sheer volume of payments only increases as customer demands and market pressures accelerate efforts. This underpins the need for high-performance infrastructure that can handle high payment volumes–and at low latencies. It’s also important they’re able to maintain state for long-running processes in the event a payment needs investigation before settlement.

Agility and innovation

Process orchestration enables organizations to take an iterative, agile approach to development and modernization. They can model and design a process that relies on legacy technology, and then incrementally replace it without disrupting the flow.

These resources can also be reused across the organization, scaling the benefits to more teams, processes, and businesses through reusability and customization. Leveraging data-backed insights from payments processes can show opportunities for operational improvement and pave the way for creating new value streams for customers.

ISO 20022 is just the beginning

The payments space is constantly in flux due to shifting consumer expectations, regulatory needs, and disruptive new solutions like nonbanks and fintech companies.

Staying ahead of change is a daunting task, but having a first-mover advantage can set institutions up to better differentiate themselves from the competition and improve how they serve customers.

Learn how Camunda can help

Check out our infographic on real-time payments and ISO 20022 migration with Camunda, or contact us to book a demo today.