Improve the efficiency and effectiveness of loan automation with Process Orchestration.

With considerable competition and ever changing regulatory requirements, taking the steps to automate and streamline your loan processing can help set you apart. Finding the right orchestration platform that can scale at the enterprise level is key to a successful solution. Let’s take a look at how Camunda Platform 8 can help you achieve your loan automation goals so you can outperform competitors and improve customer experience.

Process Orchestration is required

Effective loan processing not only requires automating a single process with a minimal number of tasks, but the orchestration of complex workflow process logic involving many departments, processes and systems. All this needs to be accomplished while meeting Service Level Agreements (SLAs) and monitoring outcomes. This is where Camunda Platform 8 comes in providing intelligent loan process orchestration.

Where Camunda makes a difference

Camunda Platform 8 offers financial institutions a developer-friendly platform with a highly scalable execution engine, Zeebe, to automate projects so you can outpace the competition. This platform allows you to execute Business Process Model and Notation (BPMN) models while maintaining microservices resilience without bulky infrastructure.

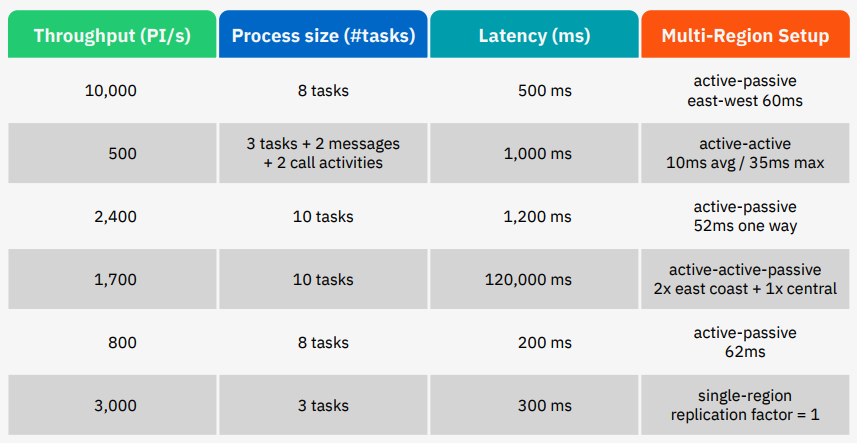

But don’t take our word for it—we have a customer in the financial industry that runs 6,000 PI/s successfully while keeping their cycle time below one second. Another customer runs 10,000 PI/s for an average process size of eight tasks in a multi-region configuration with minimal latency.

Note: PI/s represents Process Instances per second.

Financial institutions can reap the benefits of Zeebe’s cloud-native design providing the performance, resilience, and security enterprises need to future-proof their process orchestration efforts. Here’s some additional examples of performance metrics from Camunda’s customers.

Process Orchestration for loan automation

The key to automating complex processes like loan automation that involve many touch points is to have a platform that can seamlessly coordinate a diverse range of endpoints across people, systems, and devices. Financial institutions are often faced with the integration of several systems to gather and send information as part of loan automation while still maintaining human touch points. It is imperative that systems and people are connected at the right time in the process to streamline loan origination.

Human interaction

Almost every loan starts with a human request. This can be an online portal, a message, a phone call or even an in-person visit. Once data is gathered by the applicant or loan originator, it needs to be entered to initiate proper loan processing. Camunda provides an easy-to-use form editor for building interfaces for human tasks. These forms provide direct links to the loan workflow with values mapped to specific process variables. For example, the Start Date of a loan is tied to the process variable StartDate (shown in the key/value pair near the end of the JSON snippet below).

{

"label": "Start Date",

"type": "textfield",

"layout": {

"row": "Row_1b98w3c",

"columns": null

},

"id": "Field_0gvsngz",

"key": "StartDate",

"description": "Format: DD.MM.YYYY"

},Users that participate in the process, such as reviewing the loan application, can access their work from the Tasklist. They can also receive notifications by email, Short Message Service (SMS) messages, or other channels when tasks reach milestones or tasks are completed.

Note: Camunda offers rich APIs that can be used to inject data into the process from other applications or interfaces.

The right element for the job

There are several instrumental BPMN constructs available to streamline your loan automation processing with Camunda Platform 8. The wide range of BPMN elements can address a wide range of complexities that can be found in loan origination.

For example, most loans have standard criteria that must be met in order to be funded. Using business rules with Decision Model and Notation (DMN), companies can build tables with repeatable decisions around minimal credit score, points, money down, and debt-to-income ratio. Using a DMN table provides the flexibility of changing business rules without the need to modify and redeploy the process model to accommodate the changes. Your company may change these requirements based on current interest rates and other company incentives.

With customer expectations around prompt processing, many financial institutions have minimized their SLAs and publicized them, requiring quick turnaround times from prospective loanees. Camunda provides various elements to address the timeliness for loan processing including:

- Parallel Gateways – A key part of streamlining processes is allowings tasks that can run independently to do just that. With parallel processing, credit scores and other minimum requirements can be checked simultaneously with verifying documentation completeness. Once all required parallel processing is complete, the loan can quickly move forward to the next tasks.

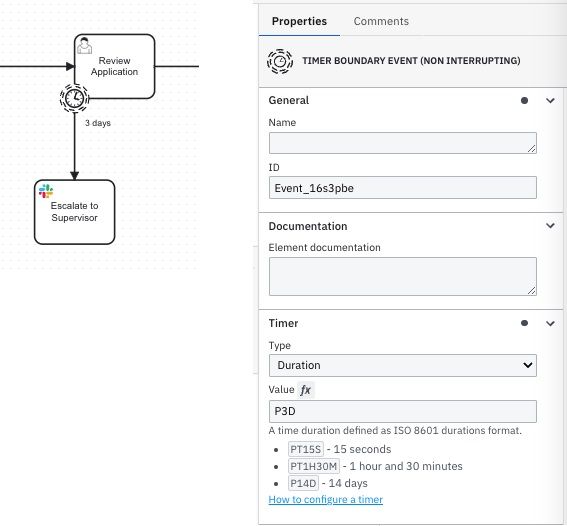

- Timer Events – Timers can be used in various instances within the loan automation process including timing certain tasks or groups of tasks and to raise awareness of an uncompleted task. For example, the SLA might indicate that we have three days to review the loan before making a preliminary decision. A timer boundary event can be used to send a reminder each day and escalate the task to a supervisor if the application processing has been stagnant for three days. In the example below, the timer is set to three days and the Slack Connector is being used to escalate the review task to a supervisor.

- Milestones – Milestones can add additional information about key performance indicators (KPI) in the process. These milestones might be “In Underwriting,” “Background Check,” or “Funding Approved,” which provide additional insight into the process—including alerting customers of the progress of their loan.

- Message Events – A message event can be used when the loan applicant sends in the appropriate supporting documentation for the loan; such as, proof of income, employment verification, proof of identity, etc. Message events reference a specific message and wait until that message is received. Once all required messages are received, then all the required documentation is received and the loan is ready for additional tasks. Messaging also plays an important role in triggering Robotic Process Automation (RPA) events for integration with legacy systems.

Service tasks

When orchestration requires integration with other systems, Camunda Platform 8 provides Service Tasks to amplify process orchestration enabling access to Enterprise Content Management (ECM) systems, Customer Relationship Management (CRM) systems, and databases.

A Service Task is a task that executes code, making it very flexible. For example, a Service Task can be used to check a customer portfolio in your CRM system and return information required for the process to continue.

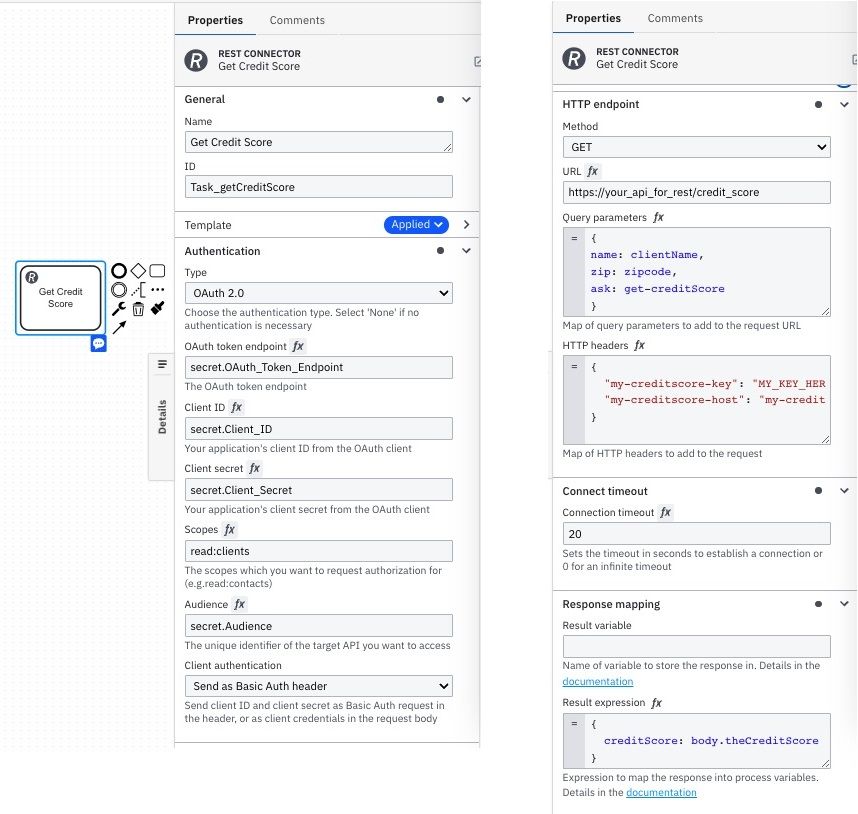

A specific type of Service Task is the REST Connector Task. As part of your loan process, you may need to run a credit score check with one of the standard credit bureaus. This not only minimizes human error, but automates the inquiry expediting the processing of the loan. The following REST Connector example depicts how you might configure this task to obtain a credit score from a REST service with Camunda.

Camunda also provides additional Connectors that can fit a particular need in your organization – from integration with AWS Lambda to connecting to a database or aforementioned ECM system. As supporting documents are received from the applicant and stored in your content management environment for regulatory requirements, for example, a Connector can provide access to those documents from within the process.

Note: If Camunda or a Camunda partner doesn’t have the required Connector, you have the ability to build your own using our provided template and the Connector Software Development Kit (SDK).

Monitoring your process

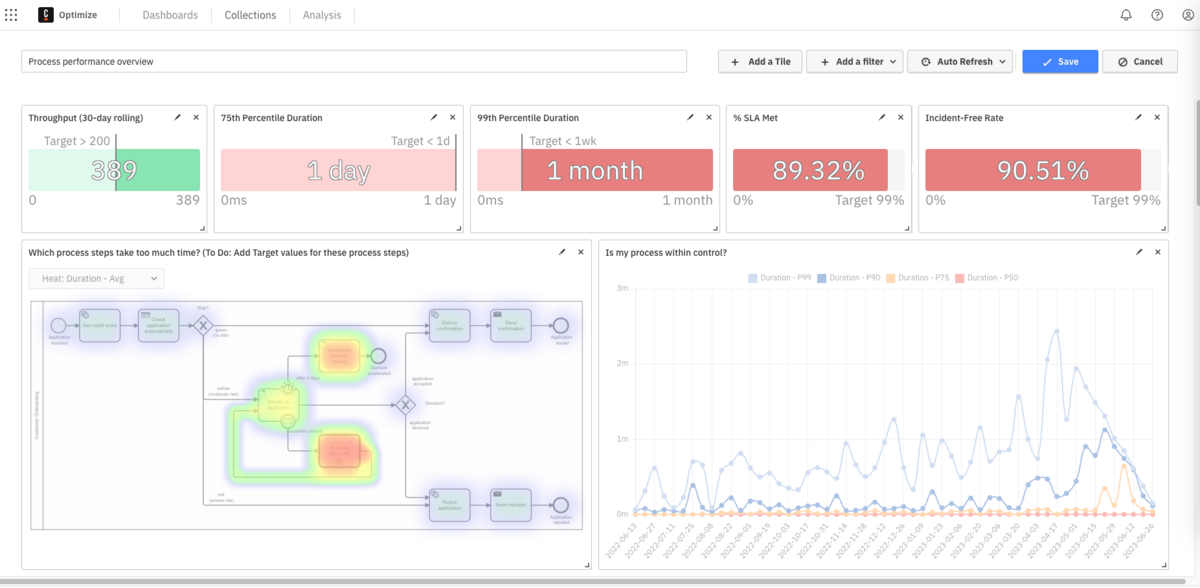

The ability to see processes in flight and determine areas of improvement is foundational to your loan processing solution. Camunda’s Operate and Optimize maximize the customer experience and loan automation to assure you are monitoring the right information and taking action on that data.

Reporting

Zeebe, the process automation engine powering Camunda Platform 8, is constantly collecting audit information which can be used to gain additional insight into your loan process orchestration. For example, how many times an escalation was required due to slow processing or if the published SLAs were achieved. In addition, information about the specific types of loan requests can be further analyzed with this data. For example, is the company receiving more loan requests with poor credit scores in a specific geographical location.

Zeebe packages two exporters (OpenSearch and Elasticsearch) which provide a method to persist historical data by pushing it to an external data warehouse. By extracting the data from Zeebe, you can then provide the extracted detail as a data source for your preferred Business Intelligence (BI) tool.

Optimization

If you don’t want to build your own reports or use an exporter, Camunda Optimize provides detailed insight into your running processes and your historic information by making REST API calls to Zeebe storing data in its own Elasticsearch database.

Companies can review User Task reports to gather statistics on idle and work time for specific tasks in the process. For example, is the human review of incoming applications a bottleneck in the automation and should an additional reviewer or pool of reviewers be added to streamline this task? Alternatively, are there other ways to leverage modeling components to automate some of these manual tasks to optimize performance for the process?

Use Optimize to take a closer look at your overall task distribution by reviewing heatmaps. Or use outlier analysis to identify processes where a certain flow node took longer than the average and dive into what might be the cause of it. Optimize provides insight into not just human tasks, but comes with preconfigured dashboards and reports to help financial institutions focus on statistics of interest that will provide details on how their processes are performing and where improvements can be made.

Conclusion

By implementing a process orchestration solution with Camunda Platform 8, you can have end-to-end visibility into your process performance and hence its improvement. Orchestrating loan automation doesn’t have to be difficult and taking advantage of what Camunda Platform 8 can offer will help launch you into your digital transformation.

Download the Financial Automation Imperative

Use automation to accelerate digital transformation, ensure compliance, and improve customer experiences

Start the discussion at forum.camunda.io